The extraction rate, and cost are as follows. So that's going to be Q and one minus Q, respectively. And therefore, from there I can calculate out what the risk-neutral probability of the up state is, and the risk-neutral probability of the down state is. It can go up by a factor of 1.2 or go down with a factor of 0.9. The current price of gold is $400 per ounce. And what is the net revenue gain that I would get from that option? So here are the details of the model.

#Real options valuation inc upgrade

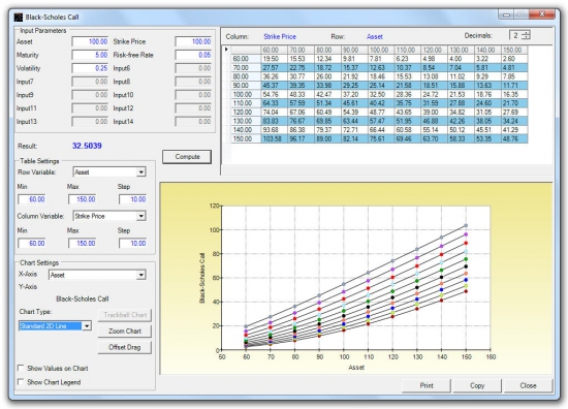

In the next half of this module we are going to value an equipment upgrade option that is also valid over the ten years that we are trying to figure out when we will exercise it. The first half of this module is about the operating option, meaning that the only thing that I'm trying to value is a lease over ten periods and every year I have the option of either shutting down the mine or operating it at the maximum possible rate. In this module, we'll go through the Simplico Gold Mine example that we introduced in the video modules. The final module is the application of option pricing methodologies and takes natural gas and electricity related options as an example to introduce valuation methods such as dynamic programming in real options. We will cover CDO’s definition, simple and synthetic versions of CDO, and CDO portfolios. The third module involves topics in credit derivatives and structured products and focuses on Credit Debit Obligation (CDO), which played an important part in the past financial crisis starting from 2007. We will discuss pricing by volatility surface as well as explanations of volatility smile and skew, which are common in real markets. The second module reveals how option’s theoretical price links to real market price-by implied volatility. Then we will analyze risk management of derivatives portfolios from two perspectives-Greeks approach and scenario analysis. Greeks are important in risk management and hedging and often used to measure portfolio value change. The first module is designed to understand the Black-Scholes model and utilize it to derive Greeks, which measures the sensitivity of option value to variables such as underlying asset price, volatility, and time to maturity. To learn more about this process, check out our guide to capital budgeting.This course discusses topics in derivative pricing. Find out more about real options analysis. The main things they will be able to alter include the size of a project, its timing, and how it will work once it’s been set up. Real options are most important to business managers when there are high levels of uncertainty, because they provide flexibility to change the course of a project if needed. Real options are different to normal financial options because they’re not something that can be traded as a security. The idea of real options is fairly recent, and was first put forward in the 1970s. What you need to know about real options analysis. People who use real options analysis include research and development managers, who might use it to help them allocate their budget between different projects. You might have heard of it being called real options valuation. Where have you heard of real options analysis? A real option is the right to undertake a business initiative, such as setting up a capital investment project.

This is a way of applying option valuation techniques to investment decisions. US30 US Wall Street 30 (USA 30, Dow Jones)

0 kommentar(er)

0 kommentar(er)